Formidable Info About How To Buy Protective Puts

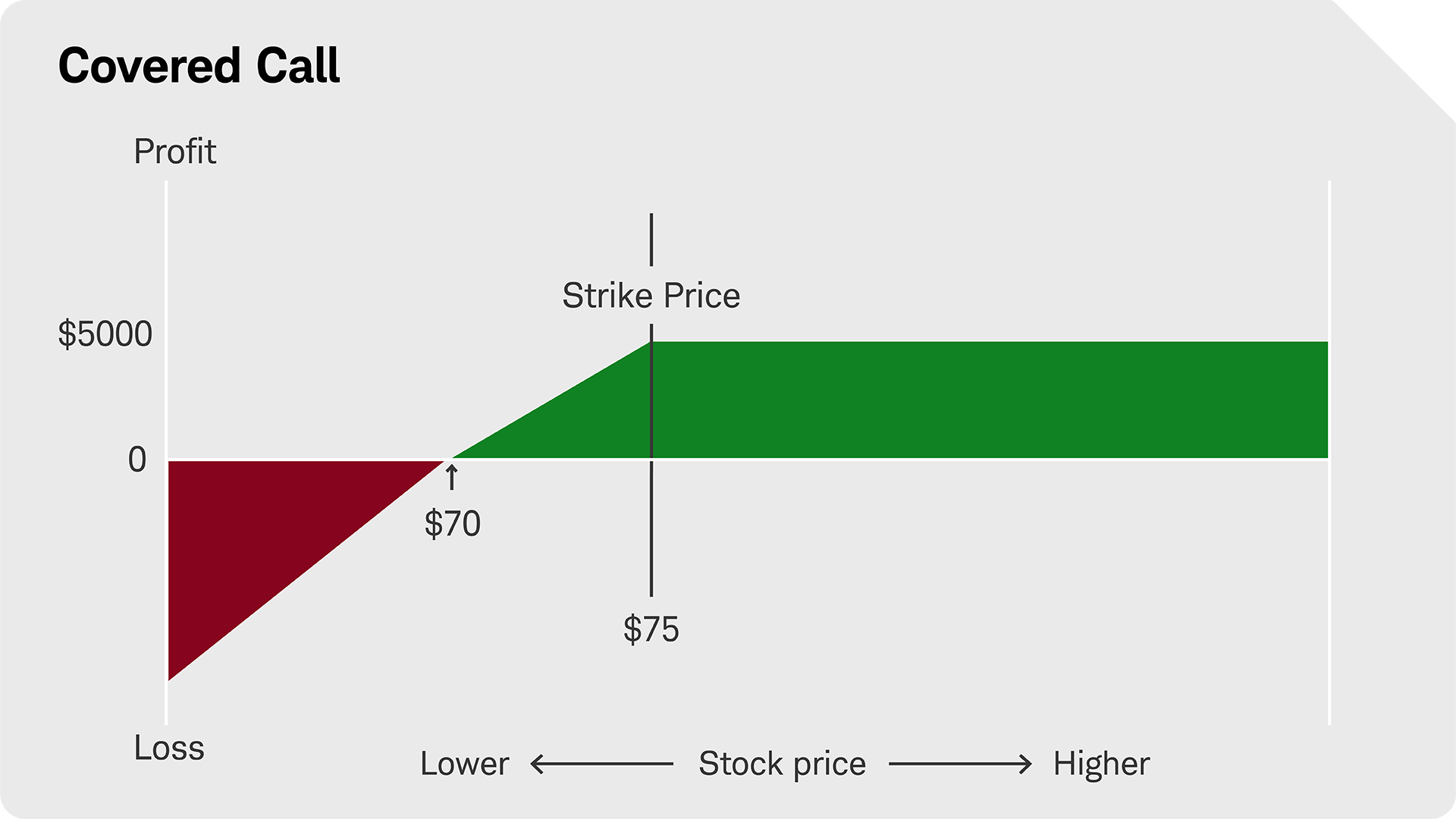

A protective put can be amalgamated with a collar strategy, which involves buying a protective put while simultaneously selling a covered call.

How to buy protective puts. You can more than hedge the downside on nvda stock by buying protection. At the time of this writing, nvda had closed at $721.50. This mitigates the cost of the.

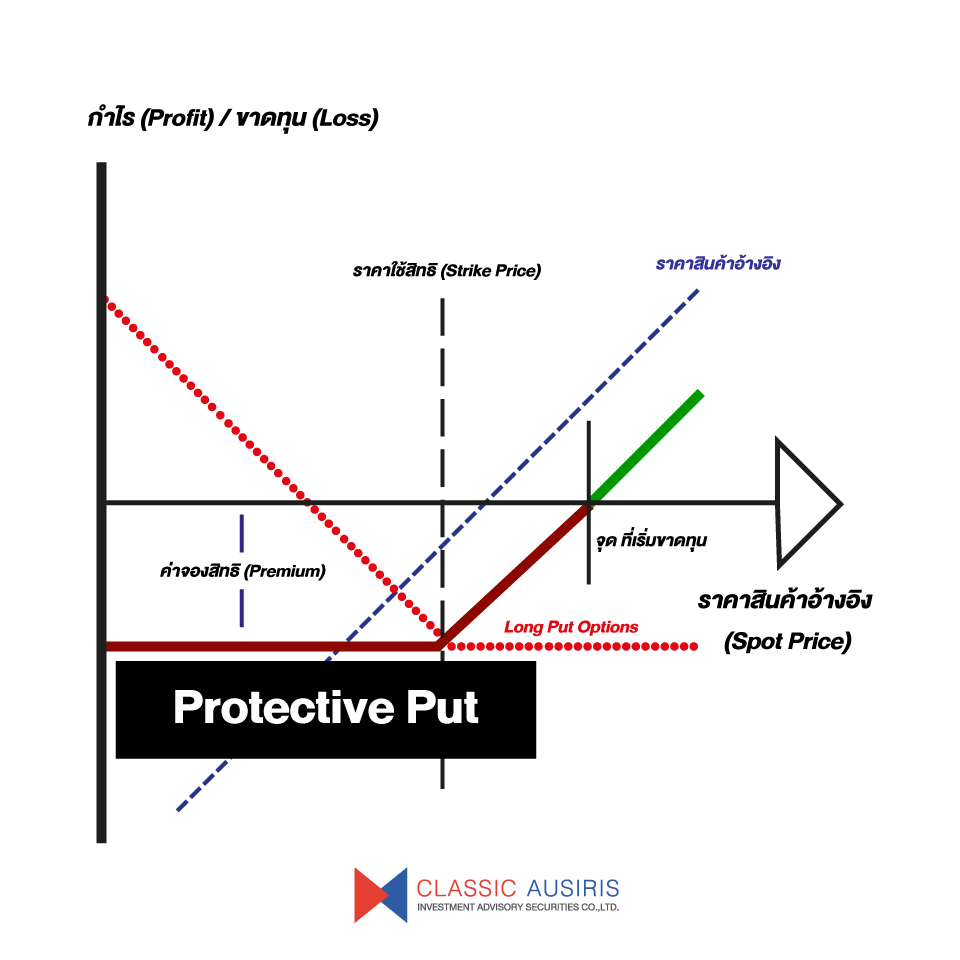

This article discusses protective puts,. Volatility can have a significant impact on a protective put strategy. Puts by themselves are a bearish strategy where the trader believes the.

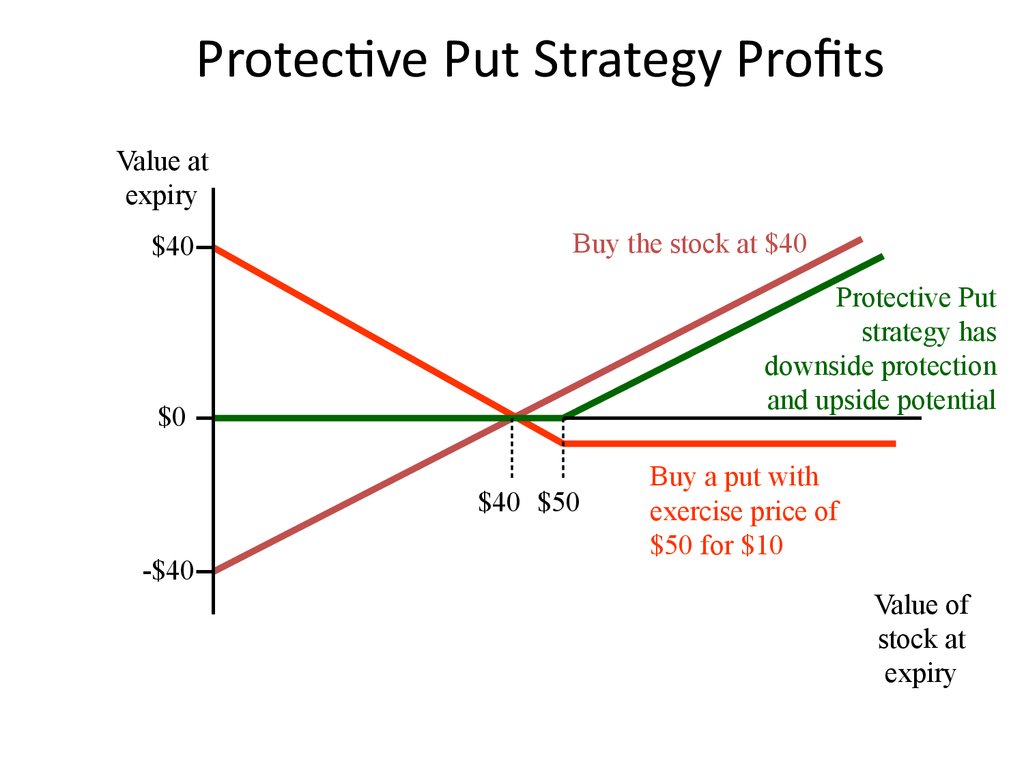

The hedging strategy involves an investor buying a put optionfor a fee, called a premium. Investors typically purchase protective puts on assets that they already own as a way of limiting or capping any future potential. It’s a long put option and long stock, where “long” means you own both.

What is a protective put? A protective put is a risk management and options strategy that involves holding a long position in the underlying. The buyer of a call has the right to buy a stock at a set price until the option contract expires.

A protective put is purchased when an investor owns an asset and wants to protect against future downside price movement. Understanding protective puts. Check out ibd's new optionstrader app.

Watch a short video on buying protective puts and see how this strategy might affect your portfolio. Put options can help protect against large price declines and are an important risk management tool for investors. For example, suppose that you own 100 shares of the spdr s&p 500.

In the example, 100 shares are purchased (or owned) and one. To execute this, investors buy puts on stocks. Protective puts involve buying puts with a strike price below the current market value of the stock to limit their losses.

You want to maintain your ability to profit from the stock price rising, but you also want. Volatility is a measure of the magnitude of price movements in the underlying asset, and it can affect the price. Protective puts are simply long put options written against an existing long equity position.

You own 100 shares or more of a particular stock (or an etf). Puts are sold in lots of 100. You can buy protective puts to protect stock you already own in times of short term uncertainty.this video will show you how they work, who the work best for.

April 18, 2023 advanced protective puts are one way to hedge stocks against a significant price drop. Investing stocks bonds value stocks how to use protective puts to limit losses written by investinganswers expert updated june 1, 2021 most of us are. The simple definition:

![Protective Put Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da311c725f876e0c27f10_Protective-Put-Options-Strategies-Option-Alpha-Handbook.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

![Protective Put Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60e7222e0b31483b2db2c010_Protective Put sizing adjustment.png)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)