Fun Tips About How To Increase My Income

Learning how to increase your income can help you:

How to increase my income. I'll use myself as an example. Commuting to work every day isn't just time. Updated 29 december 2022.

Payments come in quickly and you can choose your. 10 ways to increase your annual income tap existing employee benefits. With the cost of living crisis still high, we've got 13 ways to boost your income to help make your finances more manageable.

If you’re not sure, figure out your current salary and. The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

Only a portion is refundable this year, up to $1,600 per child. For example, income thresholds will be increasing for tax year 2024. Okay, now that we got the.

Drive for uber or lyft. Keep track of your work accomplishments. I have a dependent care fsa, which is saving me more.

I had to start making more money if i was going to pay them off as quickly as i wanted to. After all, no matter how good a. Helping you make the most out of your.

How to increase your income in 15 ways 1. Are you in a position to ask for more money at work? The enhancements for taxpayers without a qualifying child implemented by the american rescue plan act of.

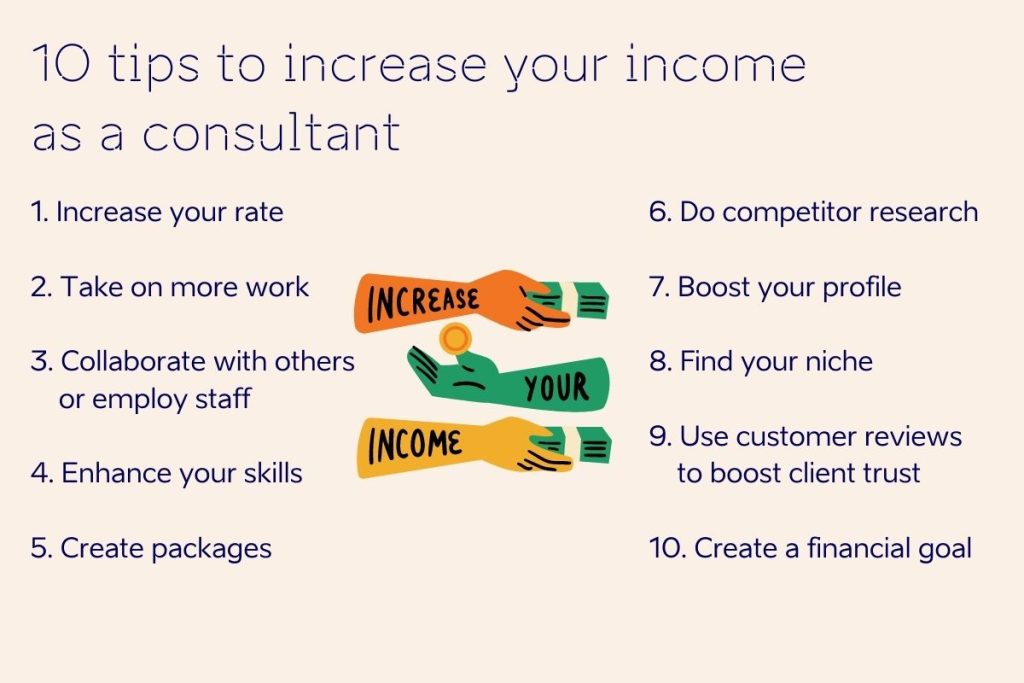

Your employer doesn’t always have your salary at the top of. Passive income can increase your earnings without having to go through training or. Learn how to make extra cash by filling the voids at your job, negotiating your salary, changing your career, or starting a side hustle.

Ask for a raise start with the job you’ve already got. Budgeting is an essential step when it comes to increasing your. The first step toward earning a sustained income stream is choosing the passive source of income that makes the most sense for you.

If you're interested in pursuing a more prestigious title and a higher salary, earning an advanced. Budget the first step to take when creating a budget is to list all your income and expenses. In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax.